Introduction

In today’s fast-paced business environment, software plays a crucial role in streamlining operations and overcoming workflow challenges. Whether it’s managing customer bookings, engineering tasks, or communication, having the right tools is essential for seamless daily activities.

A vital component of these operations is processing payments. Before merchants can access funds, numerous essential tasks must be completed, including:

- Tracking contract details, items sold, or consumption to determine the payable amount.

- Validating that the payment amount aligns with what is due.

- Collecting necessary regulatory information.

- Calculating and withholding the correct taxes.

Even after the payment is made, the process continues, requiring reconciliation of contracts, invoices, and payments with internal tools like CRMs and financial reporting platforms essential for smooth operations.

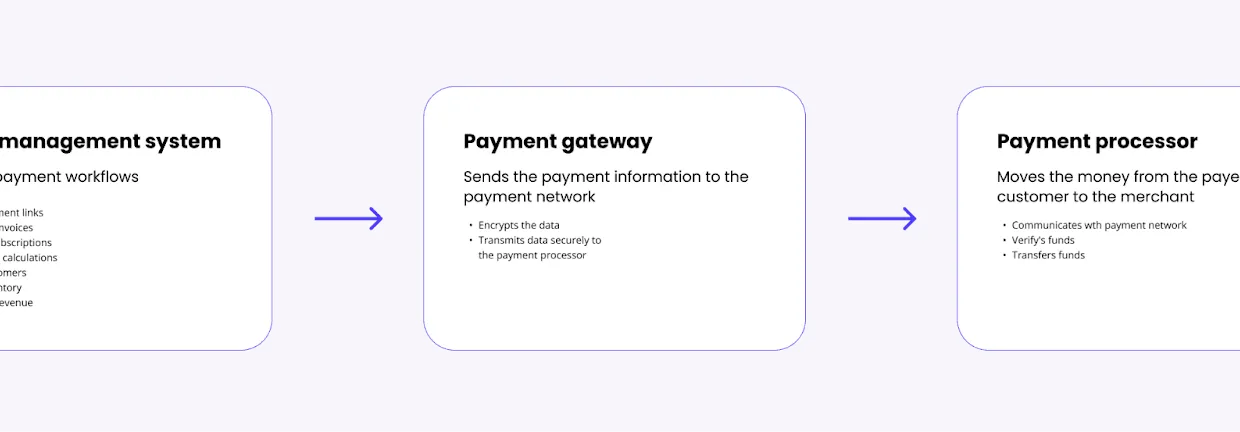

This entire workflow is managed by a billing management system, designed to handle the complex processes surrounding payment transactions. By simplifying these crucial tasks, billing systems, together with payment processors and gateways, facilitate the entire payment experience.

In this article, we’ll explore:

- The definition of a billing management system.

- Core functions of billing management systems.

- Key considerations for selecting a billing management system.

- Steps to set up a billing management system.

What is a Billing Management System?

A billing management system is specialized software that automates and streamlines the processes of generating invoices, tracking payments, and managing financial transactions between a business and its clients.

Common features of a billing system include:

- Invoice creation and delivery.

- Payment processing and recording.

- Subscription management.

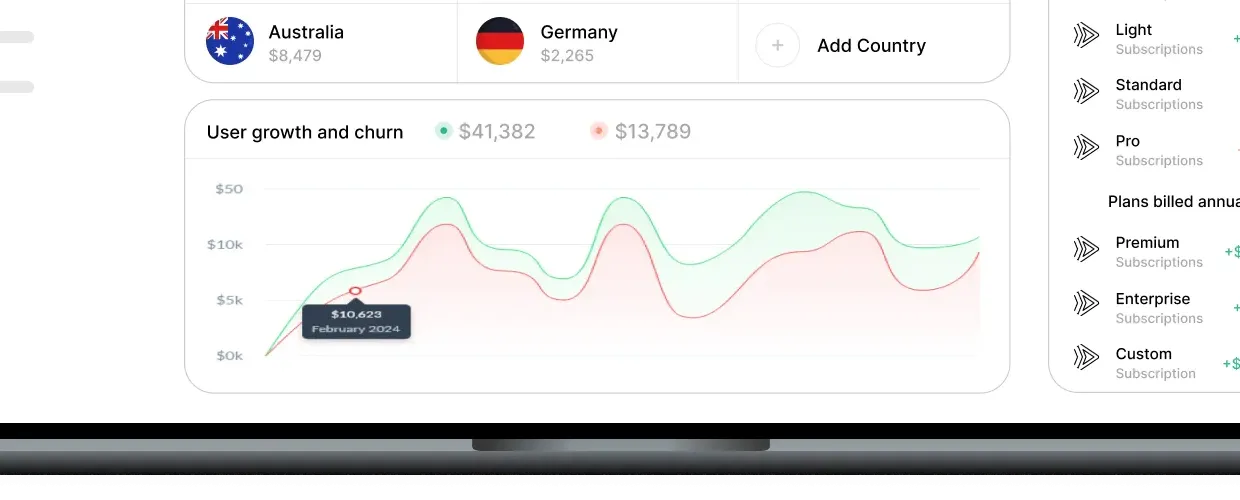

- Revenue tracking.

- Customer account management.

- Financial reporting.

These systems minimize manual work, reduce billing errors, enhance cash flow, and improve overall financial visibility. They are particularly beneficial for businesses with recurring billing models and extensive customer bases.

While some billing systems attempt to offer comprehensive solutions, many specialized platforms focus on specific verticals. For instance, restaurants may have different needs compared to software corporations. GOPayments serves as a leading choice in the market, enabling diverse billing types, including subscriptions and recurring cryptocurrency payments.

Billing systems can be categorized into various structures:

Recurring Billing Systems

- Subscription Billing: Fixed periodic charges (monthly/annual).

- Usage-Based Billing: Charges based on consumption metrics.

- Tiered Billing: Different price points based on usage thresholds.

- Hybrid Subscription/Usage: Base fee plus variable usage components.

Project-Based Billing Systems

- Milestone-Based Billing: Payments tied to project phase completion.

- Fixed-Fee Billing: A single price for the entire project.

- Percentage-Complete Billing: Payments based on verified project progress.

Time-Based Billing Systems

- Hourly Rate Billing: Charges based on tracked time.

- Retainer Billing: Pre-purchased service bundles.

- Time & Materials: Combination of hourly work plus expenses.

Transactional Billing Systems

- Metered Billing: Charges per occurrence.

- Pay-as-you-go: Services without ongoing commitments.

- Per-User Billing: Charges based on the number of users.

Value-Based Billing Systems

- Performance-Based Billing: Fees linked to achieving specific results.

- Revenue-Share Billing: Percentage of client revenue or savings.

- Success Fee Billing: Payment dependent on specific outcomes.

Specialized Billing Systems

- Freemium Billing: A free basic tier with premium offerings.

- Prepaid Billing: Services purchased in advance.

- Bundled Billing: Multiple services offered at a combined price.

These models address various business needs and customer relationships, with many platforms today capable of supporting hybrids tailored to specific market requirements.

What Do Billing Management Systems Do?

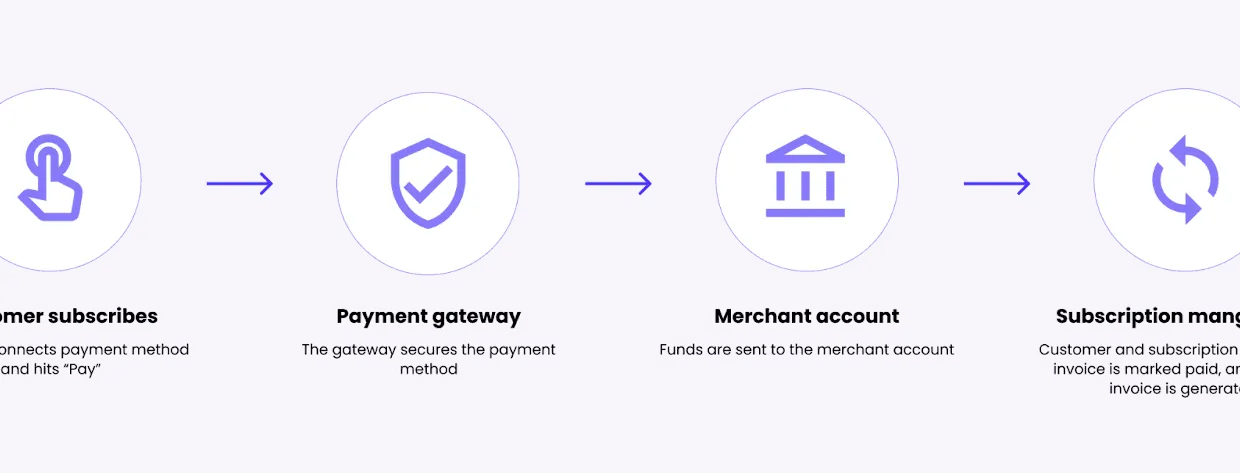

Billing management systems are integral in managing payment complexity. Their responsibilities include calculating invoice amounts, applicable taxes, enabling discounts, and supporting upgrades or downgrades in services. At their core, these systems provide functionalities to create invoices and track payments until those invoices are closed.

Billing software interfaces seamlessly with payment processors like GOPayments, ensuring efficient money transfers from customers to merchants. Payment gateways bridge the gaps between merchant systems and payment networks, while processors manage transaction approvals, including cryptocurrency payments.

Different payment processors accommodate various payment types, such as credit cards, bank transfers, digital wallets, and cryptocurrencies. Unlike traditional processors with regional focuses, crypto payment processors like GOPayments often operate globally, allowing universal access to cryptocurrency payments.

Key Considerations for Selecting a Billing Management System

When evaluating billing systems, consider the following:

- Does this solution align with my business size?

- Is it compatible with the types of billing required (invoicing, subscriptions, unique payment structures)?

- Does it integrate with payment processors supporting my desired payment methods (e.g., ACH, credit card, cryptocurrencies)?

- Can it cater to various regions my customers operate in?

It’s also vital to choose a billing system that integrates smoothly with your current tools, enhancing user experiences for both your team and customers. For instance, integration with accounting software like QuickBooks can significantly streamline operations.

At GOPayments, we prioritize interoperability, allowing seamless integration into varied billing management systems, facilitating effortless data flow into accounting and other applications.

Evaluate your business structure as well. If you manage multiple entities or require subaccounts, ensure your billing system can accommodate these complexities.

Finally, critically assess the system’s costs, aligning them with your revenue model. Many billing solutions operate on SaaS models, charging based on usage in addition to standard processing fees.

How to Set Up a Billing Management System

Following your selection of a billing system, implementation necessitates a clear mapping of your business needs and workflows. Document your billing cycles, methods, invoice designs, and revenue recognition criteria.

Implementation typically adopts a phased method, starting with configuration. For businesses with existing customers, strategize data migration to ensure a smooth transition. Consider piloting the system with new customers while gradually migrating existing ones to minimize disruption. Comprehensive testing across various billing scenarios is essential before full deployment.

Post-launch, monitor the system’s effectiveness and gather feedback for continuous enhancement. Establish concrete metrics to assess the billing system’s performance, such as reduced billing errors and improved cash flow. Regularly review the system to adapt to evolving business needs, incorporating customer feedback to enhance the billing experience.

Conclusion

Modern businesses can accelerate their launch capabilities through software that automates essential tasks. Central to these operations is the billing management system, essential for enabling secure and efficient cryptocurrency payments. Selecting a system that meets your business needs and accommodates various payment methods ensures a seamless payment experience for your customers.

FAQ

What is a billing payment system?

A billing payment system automates and manages the billing processes for a business, streamlining revenue cycles and enhancing customer experiences. It connects with payment processors, enabling seamless payments through various methods, including cryptocurrency.

What is a customer billing system?

A customer billing system, synonymous with billing payment systems, automates billing and invoicing processes, facilitating revenue generation and payment collection through effective integration with payment processors.

Which billing system should I use?

The choice of billing system depends on your specific business requirements, including revenue models and industry verticals. Ensure the system integrates seamlessly with payment providers preferred by your customers.

Is Stripe a billing system?

Yes, Stripe offers “Stripe Billing,” a solution that aids businesses in managing recurring payments and invoicing while integrating with various payment processing capabilities. Similarly, GOPayments supports companies in accepting one-time and recurring cryptocurrency payments through such integrations.

What is the best billing system for recurring payments?

For recurring payments, several well-regarded options include GOPayments, Recurly, Stripe Billing, OpenPay, and Chargebee, each offering robust subscription management features. These systems integrate with diverse payment processors, facilitating efficient billing for customers.