What is a Stablecoin?

Stablecoins are tokenized representations of assets that are crafted to maintain a consistent value. The most commonly circulated stablecoins as of early 2025 include fiat-backed types, predominantly linked to the US dollar. Popular examples are USDC and USDT, both reflecting a one-to-one relationship with physical dollars stored in bank accounts.

However, stablecoins extend beyond fiat backing. Various types are designed for unique purposes, such as asset-backed stablecoins like DAI, or algorithmic stablecoins that leverage minting and burning mechanisms to maintain value without direct collateral. This article will delve deeper into the classification of stablecoins and their diverse applications, especially in cryptocurrency payments.

Types of Stablecoins

Stablecoins can be categorized into two main groups: asset-backed and algorithmic, sometimes referred to as synthetic stablecoins. The original taxonomy of stablecoins published by JPMorgan Chase provides a clear visual of these categories.

Asset-Backed Stablecoins

Asset-backed stablecoins are created by depositing a physical dollar in a bank, after which an equivalent digital dollar is minted on the blockchain. Conversely, when businesses deposit stablecoins, the issuer removes them from circulation. Key examples include USDC, USDT, and PYUSD.

Using Circle, the issuer of USDC, as an example: they deploy a “smart contract” on the blockchain which simplifies the minting and burning process, enabling a direct digital representation of an off-chain asset. However, Circle diversifies its reserve into short-term U.S. Treasury bills, with only a portion sitting in cash across various banks.

Algorithmic Stablecoins

Algorithmic stablecoins utilize algorithms to maintain a stable value, usually pegged to a fiat currency like the US dollar, through supply-demand mechanics rather than actual reserves. The system adjusts its token supply based on market conditions, making it susceptible to volatility—historically demonstrated by prominent failures such as TerraUSD (UST).

Are Stablecoins Actually Stable?

While trusted stablecoins like USDC and USDT have shown historical stability, they might not always trade exactly at a 1:1 parity with their pegged assets due to market dynamics. Notably, during times of market stress, discrepancies can enlarge. In contrast, algorithmic stablecoins have demonstrated fragility, revealing that asset-backed stablecoins have generally proven more resilient.

Why Use Stablecoins for Payments?

Stablecoins are increasingly becoming a preferred payment method due to several compelling reasons:

Global Interoperability

Stablecoins are digital and borderless, facilitating usability across the globe. For instance, a freelance designer in Argentina can be paid in USDC by a client in Germany, bypassing traditional currency conversion and banking barriers.

Instant Settlement

Transactions made with stablecoins settle almost immediately on the blockchain, enabling faster cash flow for merchants. Unlike traditional bank transfers which may take days, stablecoin payments are nearly instantaneous, significantly improving user experience.

Lower Costs

The transaction costs of stablecoins can be significantly lower compared to traditional payment methods. Credit card processors may charge upwards of 3%, but stablecoin transfers can often incur fees as low as a fraction of a cent.

Yield Opportunities

- DAI can earn yield through MakerDAO.

- USDC can be deposited on platforms like Aave to earn interest.

- Centralized platforms also provide interest on USDC, ranging from 2% to 6% annually.

Price Stability Compared to Crypto

Stablecoins offer a hedge against the volatility typical of traditional cryptocurrencies, making them a practical choice for transactions where value preservation is crucial.

How to Start Accepting Stablecoins for Payments

If you’re a merchant ready to accept stablecoin payments, follow these three steps:

1. Integrate with Your Website or Storefront

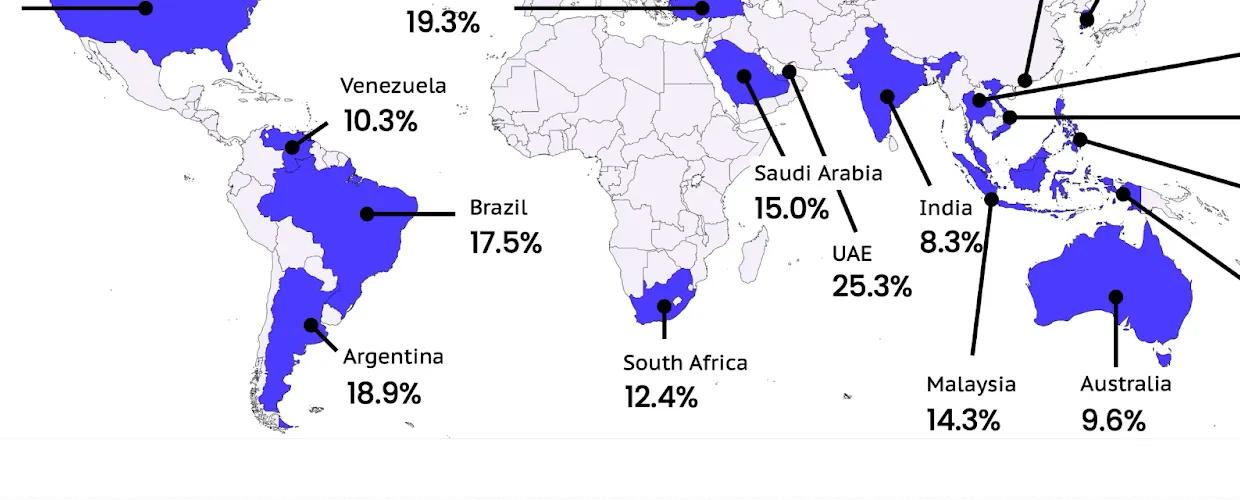

GOPayments provides an easy-to-implement crypto payment solution that can enhance your checkout process. Accepting stablecoins allows businesses to tap into the growing market of over 500 million stablecoin holders globally.

2. Decide Which Stablecoins and Networks to Use

Consider the geographic preferences and dynamics of your target market when selecting stablecoins and networks. For instance, in North America, users may favor USDC on Ethereum, while USDT may be more common on TRON in certain markets.

- USDC on Solana or Polygon

– Known for speed and low fees. - USDT on Tron

– Popular in specific regions. - DAI on Ethereum or Arbitrum

– Ideal for decentralized transactions.

3. Decide How to Receive Funds

GOPayments allows merchants to settle payments in over 45 local currencies. By connecting your bank account, you can easily receive fiat, simplifying the transaction process once stablecoins are converted.

Conclusion

To summarize, stablecoins present a robust option for cryptocurrency payments, offering benefits like global interoperability, cost efficiency, and instant settlements. As businesses look to leverage this revolutionary payment method, GOPayments stands out as a reliable solution for accepting stablecoins seamlessly, enabling you to tap into lucrative market opportunities.

FAQs

Are stablecoins always worth $1?

Stablecoins can experience small fluctuations due to market demand and liquidity factors, but typically remain close to their pegged values.

How do stablecoins differ from other tokens?

The primary distinction lies in their price stability. Stablecoins maintain a consistent value, while traditional tokens reflect market volatility.

Does the network a stablecoin is on matter?

Yes, certain networks may be more advantageous in specific regions, impacting transaction costs and user preferences.

How can merchants start accepting stablecoin payments today?

With GOPayments, merchants can easily integrate stablecoin payment solutions into their business operations, opening doors to a broader customer base.

1 thought on “Ultimate Guide to Stablecoin Payments for Businesses”